iowa inheritance tax rates 2021

As part of the reform bill Governor Reynolds signed into law on June 16 2021 Iowas inheritance tax will be phased out over four years. The federal gift tax has a 15000 per year exemption for each gift recipient in 2021 and 16000 in 2022.

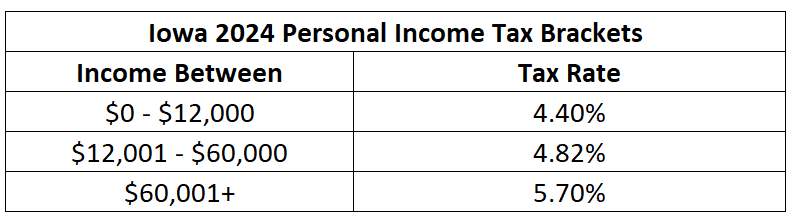

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Read more about IA 8864 Biodiesel Blended Fuel Tax Credit 41-149.

. Spouses children and even parents were already excluded from paying the. Track or File Rent Reimbursement. Law.

See IA 706 instructions. State inheritance tax rates. IA 8864 Biodiesel Blended Fuel Tax Credit 41-149.

Read more about Inheritance Deferral of Tax 60-038. On May 19th 2021 the Iowa Legislature similarly passed SF. There is no federal inheritance tax and only six states have a state-level tax.

It is the estate of the deceased that is responsible for the tax. Note that historical rates and tax laws may differ. Only six states actually impose this tax.

60-061 01032022 Pursuant to Iowa Code chapter 450 the tax rates are as follows. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Iowa Inheritance and Gift Tax.

The estate tax is only paid on assets greater than 53 million per individual 106 million per couple. Even if no tax is due a return may still be required to be filed. Below are the ranges of inheritance tax rates for each state in 2021 and 2022.

While the top estate tax rate is 40 the average tax rate paid is just 17. With passage of the new bill if one were to pass away in 2021 the inheritance tax imposed on the inheritor would be reduced by 20 from the original. A bigger difference between the two states is how the exemptions to the tax work.

Overall Iowa Tax. Register for a Permit. Inheritance Deferral of Tax 60-038.

Read more about Inheritance Tax Rates Schedule. The Iowa inheritance tax rate varies depending on their relationship of the inheritors to the deceased person. Inheritance tax of up to 16 percent.

Iowa Inheritance Tax Rates. Tax rates range from 18 to 40. If the net estate of the decedent found on line 5 of IA 706 is less than 25000 the tax is zero.

Here are the tax rates for this group. Inheritance tax is a tax on the privilege of transferring property to your heirs. Federal estate taxes apply to estates worth more than 117 million as of 2021.

The repeal of the Iowa inheritance tax follows the trend across the country to reduce such taxes. The legislation also removes revenue triggers implemented in the 2018 tax reform law to further drop the income tax rates on January 1 2023 with the top rate dropping from 853 percent. The rate threshold is the point at which the marginal estate tax rate kicks in.

The tax clearance releases the property from the inheritance tax lien and permits the estate to be closed. If you have questions or need assistance concerning inheritance taxes please reach out to our office at 515 225-1100 or through our contact page. The hope is to convince more retirees to choose Iowa as their state of residence.

Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. In 2021 Iowa decided to repeal its inheritance tax by the year 2025. As part of the reform bill Governor Reynolds signed into law on June 16 2021 Iowas inheritance tax will be phased out over four years.

For deaths in 2021-2024 Iowa will reduce the estate tax rate by an additional 20 each year until the tax is fully phased out. Inheritance taxes in Iowa will decrease by 20 per year from 2021 through 2024. 50001-100K has an Iowa inheritance tax rate of 12.

Pre-2021 taxiowagov 60-061 01032022 Pursuant to Iowa Code chapter 450 the tax rates are as follows. 619 a law which will phase out inheritance taxes at a rate of 20 per year and completely eliminate the tax by January 1st 2025. In 2021 Iowa passed a bill to begin phasing out its state inheritance tax eliminating.

As previously stated if a decedent dies in 2021 onwards their beneficiaries would pay a lower Iowa Inheritance Tax Rate if the decedent passed away in. If the bill becomes law three changes could take effect on Jan. This is some text inside of a div block.

See General Instructions for Iowa Inheritance Tax Return IA 706. Learn About Sales. Learn About Property Tax.

Even if no tax. DES MOINES Iowa The Iowa Senate on Wednesday passed 46 to 0 SF 576 a bill that repeals Iowas inheritance tax and state qualified use inheritance tax. Inheritance Tax Rates Schedule.

A summary of the different categories is as follows. For more information on the limitations of the inheritance tax clearance see Iowa Administrative Code rule70186122. Change or Cancel a Permit.

Lower the top individual income tax rate from 853 to 65. Probate Form for use by Iowa probate attorneys only. On June 23 2021.

If the net value of the decedents estate is less than 25000 then no tax is applied. It would also eliminate Iowas inheritance tax over three years. If you give a single person more than 16000 in a single year you must file that gift with the IRS.

Iowa has an inheritance tax but in 2021 the state decided to repeal that tax by 2025. 2021- 20 less than the original rates 2022- 40 less than original rates 2023- 60 less than original rates. Iowa was one of just six states in the country to still impose an inheritance tax.

The federal estate tax exemption increased to 1170 million for deaths in 2021 and 1206 million for deaths in 2022. Inheritance tax in Iowa will decrease by 20 per year from 2021 to. The vast majority of estates 999 do not pay federal estate taxes.

In the meantime there is a phase-out period before the tax completely disappears. File a W-2 or 1099.

Iowa Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Iowa Estate Tax Everything You Need To Know Smartasset

How Do State And Local Individual Income Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

States With Highest And Lowest Sales Tax Rates

Iowa State 2022 Taxes Forbes Advisor

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Iowa Estate Tax Everything You Need To Know Smartasset

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

How To Avoid Inheritance Tax In Iowa

How Is Tax Liability Calculated Common Tax Questions Answered

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation